Posted by: mitha.ismalyulii

311 View

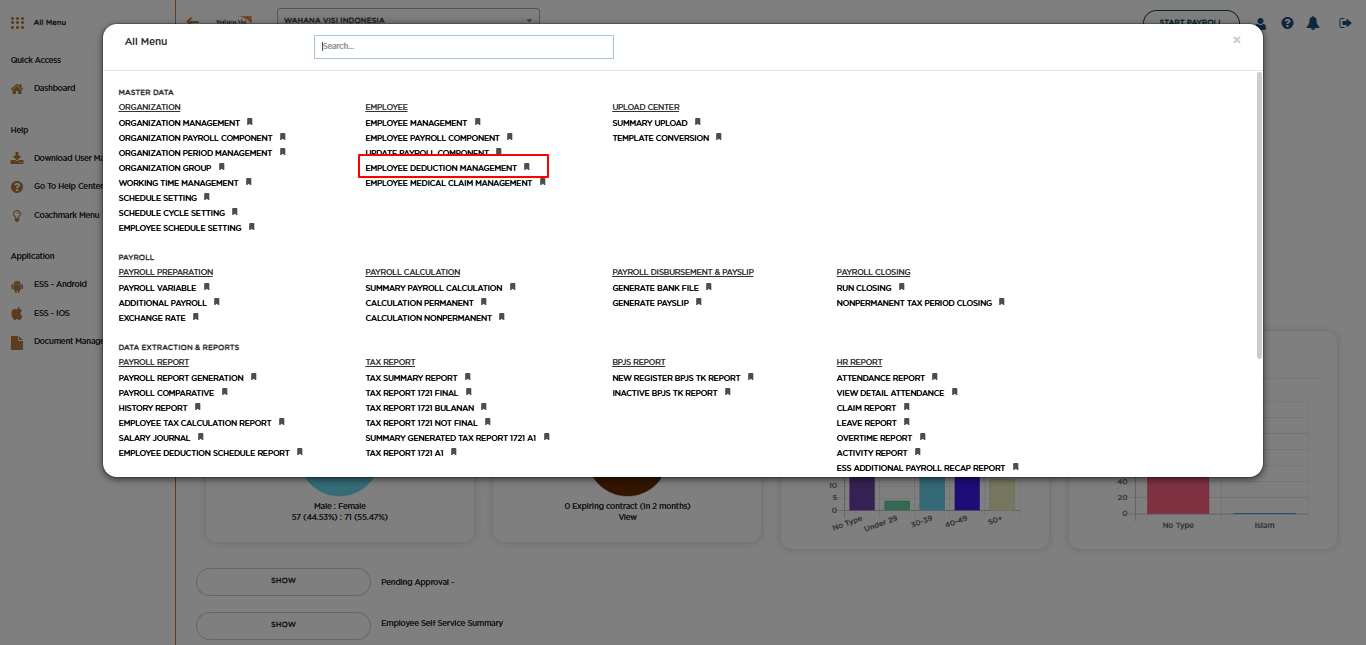

Employee Deduction Management

Employee Deduction Management, berfungsi untuk mengelola potongan karyawan dalam sistem yang bentuknya regular dengan jangka waktu (tenor) tertentu seperti Pinjaman yang diambil oleh karyawan dan harus dipotong setiap cycle penggajian.

Employee Deduction Management is a feature to manage employee deductions within the system that is regularly deducted from employees payroll within specific period of time such as Employee Loan.

Bukalah melalui link berikut: https://www.benemica.com/Payroll/Loan/index

Access the following link: https://www.benemica.com/Payroll/Loan/index

Sistem akan menampilkan semua data Employee Deduction yang sudah disetup sebelumnya

System will show all the existing Employee Deduction in the system

-

Klik pada tombol New.

Click on the New button.

-

Isilah “New Employee Deduction” untuk mengelola berbagai bentuk potongan gaji karyawan.

Fill out the "New Employee Deduction” to manage various forms of employee payroll deductions.

- Deduction No: Nomor yang digenerate untuk identifikasi potongan gaji yang baru ditambahkan.

- Employee ID: Pilih ID karyawan yang akan dikenakan potongan gaji.

- Deduction Type: Pilih jenis potongan, seperti pinjaman pribadi, pajak, asuransi, dll.

- Component Linkage: Opsi untuk menghubungkan potongan dengan komponen penggajian tertentu.

- Component yang dapat dipilih adalah component yang memiliki Component Group LN - Loan

- Currency: Mata uang yang akan digunakan untuk jumlah potongan.

- Deduction Amount: Masukkan jumlah potongan yang akan diterapkan.

- Outstanding Deduction Amount: Jumlah potongan yang masih belum terbayar.

- Rate: Persentase atau nilai untuk menghitung potongan. Data ini bersifat informasi saja. Nominal yang akan dijadikan dasar perhitungan adalah Deduction Amount

- Installment Amount: Jumlah cicilan potongan per periode.

- Tenor: Lamanya jangka waktu potongan dalam bulan.

- Outstanding Tenor: Sisa jangka waktu potongan yang belum terselesaikan.

- Deduction No: The generated number to identify the new deduction.

- Employee ID: Select the employee ID who will be subject to the deduction.

- Deduction Type: Choose the type of deduction, such as personal loan, tax, insurance, etc.

- Component Linkage: Option to link the deduction to a specific payroll component.

- Components that are going to be shown and can be selected are component with Component Group LN - Loan

- Currency: The currency to be used for the deduction amount.

- Deduction Amount: Enter the deduction amount to be applied.

- Outstanding Deduction Amount: The remaining deduction amount that has not been paid.

- Rate: The percentage or value used to calculate the deduction. This Data is information only. The amount that is going to be considered in the calculation is the amount in the field of Deduction Amount.

- Installment Amount: The deduction installment amount per period.

- Tenor: The duration of the deduction in months.

- Outstanding Tenor: The remaining duration of the deduction that has not been settled.

-

Klik Save.

Click Save.